Howdy, everyone. Here are the Top 5 key terms of Financial Literacy you need to know. Financial literacy is much required when you handle daily living.

Some people might not have studied these terms or were not present in their curriculum or due to any other reason, but now you will because will explain these key financial literacy terms.

Even though these financial terms are crucial to successful adulting, these are crucial in life to make certain decisions in finance which might impact their lives somehow. Mastering these terms won’t always be that easy but, with a little bit of practice, will benefit you for a good future ahead.

Top 5 key terms of Financial Literacy you need to know

-

The Basics of Budget Making for Financial Literacy

Creating and implementing a budget is one of the most basic criteria to fulfill for successful financial planning. In this modern-day, it’s easier than ever to create a budget with the help of websites and apps, such as Mint.

It doesn’t matter if maths isn’t your strong point – thanks to these user-friendly online websites, everyone can get help with keeping their finances on the check. And, when used properly, they’ll tell you about where your money is actually going.

Without following a budget, it’s difficult to hold yourself accountable on where your money is coming from and what it’s going toward, so mastering the basics of budgeting is where any financial study beginner should begin.

-

Understanding the Interest Rates

While you may touch upon the concepts within a mathematics course, it’s important to understand different aspects, like compound interest. Because you get paid by banks on the basis of compound interest. So, you need to know about that for sure.

Not only can it help you save even more, but it can make the difference between borrowing a small amount and paying back much more than you need to for years to come, you would already be able to calculate and anticipate everything.

-

Most Important part is Saving

Obviously, saving is the most important aspect of maintaining a healthy financial situation. But, the majority of people don’t show interest in this term as much as they should. It also adds a sense of peace among individuals.

It’s easy to ignore things like retirement since it seems so far off in the future, people don’t think of long-term they are myopic.

Learning to save early on can help you gain the knowledge, practice, and set of skills you’ll utilize throughout your entire life. You can start by saving money for a costly item they desire. Working towards a goal is key here because the bills will always be there.

-

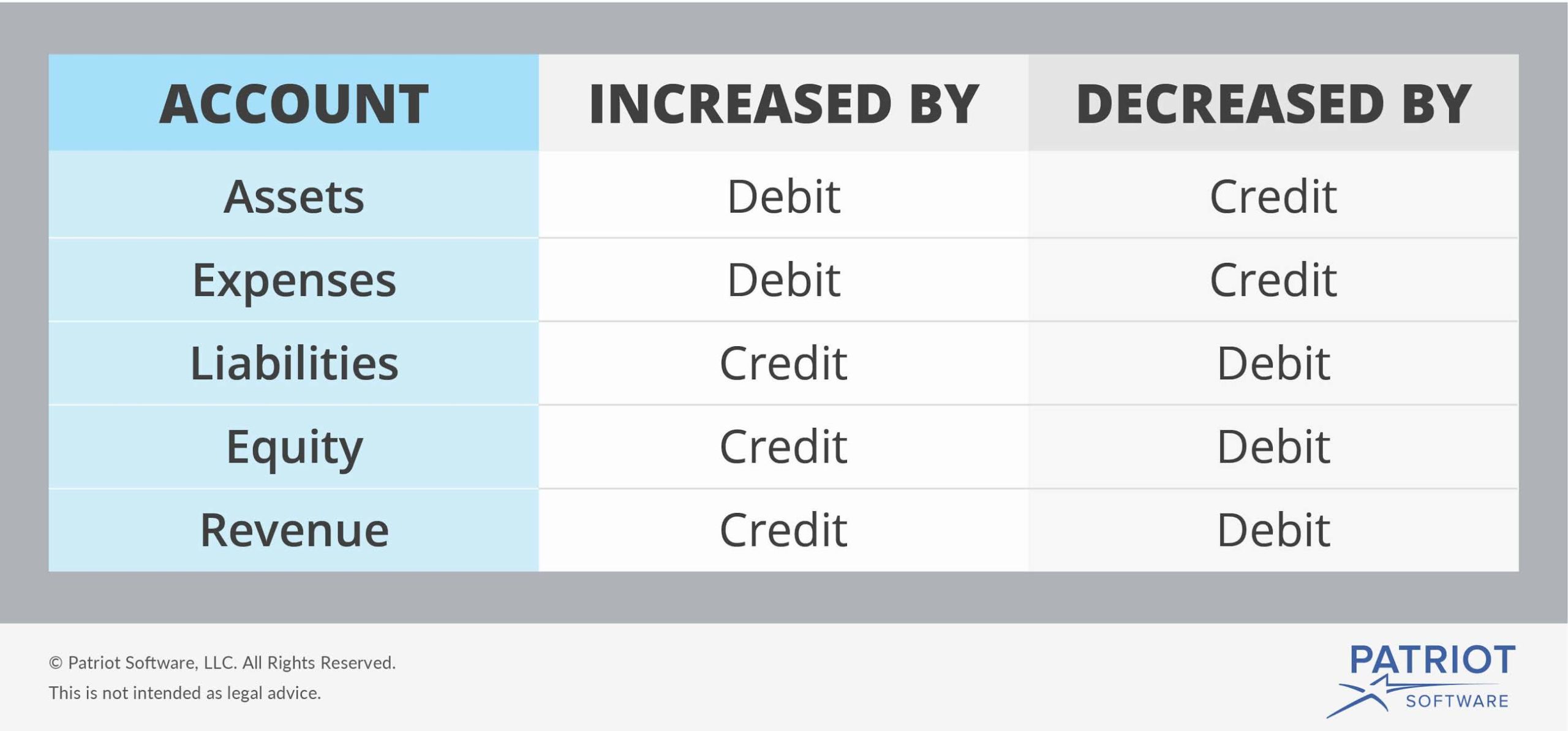

Credit-Debt

Meaning: it’s much easier to lose credit than gain it and many people don’t realize how easy it is to ruin their credit – and how difficult it can be to regain credit – before it’s too late.

Credit can be an extremely useful tool – if it’s managed correctly. Making rash decisions when you’re young can end up costing you throughout adulthood so it’s important to grasp the concepts and tools behind responsible credit practices as early on as possible. Credit can be sometimes good when used in long term due to various economic effects.

Credit means the ability of a customer to obtain goods or services before payment, based on the trust that payment will be made in the future.

Debit means a payment made or owed to someone.

-

Online Money Theft Issues & Safety

In this 21st century, identity theft, or account hacking is more prevalent than earlier. Since everything is digital and just about everyone has shopped online at one point or another, your financial information is more vulnerable to fraud than anything else.

Understanding this concept, along with preventative measures, like password protection, 2-factor authentication, and limiting the amount of information shared online can be the key to maintaining safer accounts or, inversely, can lead to financial ruin.

While it’s not flawless (people can be safe and things do still happen) it’s important to safeguard your finances as best as possible to avoid the threats that exist.

Thanks for reading Top 5 key terms of Financial Literacy. Also, check about the Top 5 Key Terms related to Finance and Economics one must know!